Season 4: Episode #137

Podcast with Jacob Effron, Principal, Redpoint Ventures

"The macro trends driving the growth of digital health funding are still in place"

Hosted by Paddy Padmanabhan

Hosted by Paddy Padmanabhan

Share

In this episode, Jacob Effron, Principal at Redpoint Ventures, discusses the venture capital (VC) environment for digital health. Redpoint Ventures is a venture capital firm focused on investments in seed, early, and growth-stage companies and has been investing in the healthcare tech landscape for the last decade.

Jacob believes that the fundamental trends driving the growth of digital health are in place. However, later-stage companies looking to raise additional capital may experience some uncertainty in the short term. He also talks about the demand environment for Redpoint’s portfolio companies and his advice to founders looking to navigate the health system space. Take a listen.

Show Notes |

||||

| 00:32 | Jacob, tell us about Redpoint Ventures and your role. | |||

| 02:56 | Give us your State of the Union on where we are with digital health, especially the younger companies. | |||

| 05:24 | Have you changed focus considering what's happening in the macro environment? Are you investing more in one stage versus another? | |||

| 06:52 | What are you hearing from the startup entrepreneurs and the founders about the demand environment, their operations, the talent etc.? | |||

| 10:10 | What are you hearing from the market about the demand environment for digital health solutions? | |||

| 11:43 | You mentioned value-based care and how startups now must get creative about demonstrating value, taking on risk, and being able to put more money at risk to earn the right to a seat at the table. Tell us how that's playing out. | |||

| 16:07 | What do you think of the policy environment? Are there things that you would like to see in the near term that could make a difference to the picture? | |||

| 18:34 | What are some of the core attributes you seek before you begin funding one of these startups? | |||

| 21:43 | The competitive landscape for the startups today has big tech---Amazon, Microsoft, Google, Apple---coming into the core healthcare services space. What’s your take on what this means for smaller companies? | |||

| 24:04 | What's your take on what to expect for 2023 and what are you advising your followers? | |||

About our guest

Jacob Effron is an investor at Redpoint Ventures specializing in digital heath. He's an operator-turned-investor, having worked as a product leader at Flatiron Health before going into VC in 2019. Jacob’s background as an operator grants him firsthand knowledge of the pain points that health techs go through. He also regularly shares his thoughts on the digital health industry and how he’s approaching his investments on his Substack, Vital Signs with >2K subscribers including many CEOs and industry veterans.

Jacob Effron is an investor at Redpoint Ventures specializing in digital heath. He's an operator-turned-investor, having worked as a product leader at Flatiron Health before going into VC in 2019. Jacob’s background as an operator grants him firsthand knowledge of the pain points that health techs go through. He also regularly shares his thoughts on the digital health industry and how he’s approaching his investments on his Substack, Vital Signs with >2K subscribers including many CEOs and industry veterans.

Q. Jacob, tell us a little about your firm and your role there.

Jacob: I’ll start with Redpoint and then, give a bit of background on myself. Redpoint is fund, and kind of a classic Silicon Valley venture firm. We’ve been around since the late nineties and the heritage of the fund’s really on the side of enterprise software, data infrastructure, and other categories. So, think companies like Stripe, Snowflake, Twilio and HashiCorp and Ramp. But in the last decade, we’ve gone into health care in a big way so, it’s actually about a quarter of our fund, now.

The way we think about it is really in bringing the best of enterprise software, data tools, consumer experience, fintech etc. that we’ve come to expect in every other part of our lives into health care. As a firm, we’ve invested in companies like Cityblock Health, Galileo Health, Strive Health, AcuityMD, Garner Health, and hims —a whole host of a really exciting companies. That’s where I spend my time.

In terms of my background, I joined the health care policy side in college. Then, I started my career at McKinsey working with state Medicaid agencies, payors, providers, and pharma companies. Subsequently, I went over to Flatiron Health, which was doing Big Data for Cancer treatment to help start a new business line there. Eventually, I joined the product team and helped build workflow tools for Cancer centers we worked with. After we got acquired (by Roche), I switched over to the venture side and have been at Redpoint for the last two and a half years.

Q. With regard to the digital health landscape, we’ve moved from celebrating the blow out funding numbers for startups here to a blowing up of some of these companies. Give us your State of the Union on where we are with digital health.

Jacob: One of the interesting parts of being at a firm that invests in health care tech is, you get perspective on what’s happening across spaces that venture capital firms invest in.

There are a series of later stage companies that raised rounds last year when the market was roaring and people thought good times were exclusively ahead. Now that the public markets have really corrected in every space—in software, fintech, and health care—a lot of people don’t know what these later stage health care companies are worth.

What that means is—and I’ll bifurcate what’s happening in digital health investing right now to early stage and later stage—on the later stage side, there’s just a bit of confusion as to what these companies are worth. People are waiting to see that. With the public markets moving around so much, there aren’t that many health care companies that are public, so, there aren’t that many examples to point to that are analogous to a lot of these startups. In that environment of confusion, folks may be a little bit reticent to invest in some of those later stage health care companies. A lot of the later stage companies are then, facing a period of uncertainty.

One has to make sure you’ve got runway to see it through to greener times. The overarching theme then, is like all the macros that are driving health care and this is really relevant to the early stage. They’re still there. None of that’s changed because of the current environment. That’s not like last year when the health care cost curve was going up a ton. This year, it’s suddenly flattened. Last year, there was a need for technology and providers, payers, pharma, and that’s suddenly changed. So, all the thematic reasons that make digital health really interesting are still there.

However, I don’t think the market’s changed dramatically for early-stage companies and really, for strong teams, and going after interesting problems. It’s really these later stage companies where there’s just uncertainty about how they should be priced.

Q. Have you changed focus in light of what’s happening in the macro environment? Are you investing more in one stage versus another, now? How’s your firm looking at this?

Jacob: We’ve retained focus on the same stage, throughout. Certainly, there are opportunities across the board and the saying, “No one knows how to price some of these growth rounds” is interesting. They’re actually becoming interesting opportunities.

There are some great later stage health care companies that are in the private markets that maybe were planning to IPO and now, isn’t really a great time to do that. There continue to be more interesting opportunities across the board but it’s just that maybe last year those deals were priced at a certain price and now they’re not pricing at that level.

Q. What are you hearing from the entrepreneurs and the founders running these companies about the demand environment, their operations, the talent etc.?

Jacob: There’s a lot there so maybe I’ll start with the talent side.

There’s an interesting opportunity on the talent side for digital health where in the past, maybe large tech companies have been able to pay salaries that dwarf what any digital health company can pay. So, anytime you’ve got this inflection in the market as a whole, it’s like an interesting dislocation where it forces people to reconsider, “Oh! I thought I had all these options and I thought they were going to be worth so much money that I had golden handcuffs and I was going to stay at this, at Facebook forever.” Now, people are rethinking that.

One trend I’ve seen across the board is that folks want to do more mission-driven work that’s meaningful to them. I talk to people all the time and they’re like, “I want to go into health care or climate.” So that’s where they want to spend time and for a while it’s actually a really interesting talent market.

Across the board, in our portfolio companies, we’re seeing incredible engineers, product people that maybe are using this current environment as a inflection point to think about, “Okay, what do I want to do with this next stage of my career?” On the talent side, I hope to see this continued influx of folks into the digital health space, which is really interesting.

On the customer side, I guess a classic investor thing that has always made people interested in health care is that it is in many ways countercyclical. There’s this fear in software at large right now that like all these startups sell to other startups. And the second the music stops, there aren’t as many startups out there like all these companies.

Actually, in health care, a lot of our customers and companies sell to large employers, hospital systems, or pharma companies and certainly, there’s a tightening of the belt across the board. But again, back to the original point, the problems haven’t changed. If anything, you have some companies that actually make for really interesting inflection points. For instance, we have one portfolio company, Garner Health, that focuses on helping employers lower the cost of care and improve the member experience. That’s actually even more relevant in this current environment. They have a lot of folks that are seeing the premium costs for next year and saying, “In this economic environment especially, that’s something we really want to tackle.”

Q. With regard to the enterprises—health plans or health systems—what are you hearing from the market about the demand environment for digital health solutions?

Jacob: It’s interesting that on the health system side, maybe if you were to bucket different kinds of solutions, there’s stuff that feels like, “Hey! This is a point solution that just does, a very specific thing or, seems cool like a cool algorithm or a cool tool.” But it doesn’t really have an ROI or that’s unclear, still TBD (to be decided).

We’ve always been reticent to invest in some of that and in this environment, you’re really going to see a bifurcation of tools that are broad in scope, that can really be partners for systems at a much larger level, along with tools that have clinical and financial studies behind them and proof points in case studies with other systems that they work. You do find the best but in this current environment, it’s a really hard time for systems right now.

When you approach a system to talk about specific clinical applications in one department that maybe has some clinical validity, it’s about how much time you get relative to the person that’s like, “Hey! I understand the staffing challenges you have and here’s something that we’re building around that.” Or “Let’s talk about revenue cycle.” Or “Let’s talk about patient engagement and keeping folks within your system.” Or “Let’s talk about some of these new, value-based models you may be moving into.”

The current environment forces a prioritization. That’s always been there because it’s always hard to sell to these systems and payers if you’re not one of their top two or three priorities.

Q. You mentioned value-based care and so let’s talk about how startups now have to get creative about demonstrating value, taking on risk, and being able to put more money at risk in order to earn the right to a seat at the table. Tell us how that’s playing out.

Jacob: There’s an increasing trend of startups moving from a fee for service world to actually taking on risk for the services they provide. In some ways, it’s the ultimate kind of confidence in your own model to say, “We’re not just showing you a pretty slide that says this thing saves money. We’re so confident it does that we’re willing to go at risk for that.” A few trends that happened have really enabled that.

The first is, a lot of this stuff follows government policy. There’s been a lot of government policies over the past decade and even more in the last two, three years that have created these interesting models that startups can then, opt into. A lot of times the government creates these models—first, it was ACOs, then, these kidney choice models, and now, direct contracting and easier reaching. They just announced the enhanced Oncology model. So, there’s a whole host of these different models the government introduces, but then private payers also latch on to you. All this it creates an interesting opportunity for startups to provide care in a different way.

If you think about what a lot of these companies want to do anyway, they want to provide a higher touch, better consumer experience type care, and these payment models enable them to do that. So, there’s a lot of promise in these kinds of businesses. There are early proof points as seen through companies like Validate, Know Street that have demonstrated really interesting outcomes both, clinical and cost related. So, a lot of folks will look at those companies and at their valuations, the way that Oak Street, Agilent, and Validate Health are all valued. They’ll say, “That seems, in a way, like we can do things that are in line with how we want to provide care and also stay financially lucrative.”

Q. Healthcare is very good at following the money and notwithstanding all the excitement about alternate payment models, value-based care, and risk based, the vast majority of health care payments still go through some model. Do these models work better perhaps for employers but maybe not as much for health systems? Is there a nuance there worth thinking about?

Jacob: A few thoughts on that. One, as you well know, healthcare is just so massive that all these worlds can coexist and still be really big. You’ve got Oak Street, which, depending on the day is a $5-6 billion company or a ChenMed—All these things that people talk about have done a wonderful job and created a lot of enterprise value but they touch less than one percent of Medicare patients. And there are still massive businesses.

Then, you have the systems that are more in the fee for service world. I totally agree with the point that almost all payments in the system world are on the fee for service side now. It’s obviously been slower to move to value based than maybe some of the independent physicians and groups, but both worlds can coexist and still be pretty large for the time being.

I do think it’s a really good point that on the system side, there are a lot of people that come in and they say, “Oh! We’re going to sell value-based care and do something that really works in those models.” However, in these challenging times for systems, you can’t go into a room pitching someone and talking about something that’s not one of the top two or three things they’re thinking about. A lot of times when we talk to early-stage companies, we encourage them that they’re going to do something in the value-based world where a lot of the innovation is really happening.

Q. What do you think of the policy environment? Are there one or two things that you would like to see or do you anticipate in the near term that could make a difference to the picture?

Jacob: On the value-based care side, the big policy question is whether any of these models are going to be made mandatory at some point. If I think about how they’ve evolved, basically about how these benchmarks get set up, how much should it cost to take care of a population etc., it’s a median or an average.

As you can imagine, companies are very good at saying, “Well, you’re in the top quartile of practices. So, if you don’t lift a finger or change anything, you will do better in this model than you were doing in the status quo, because it was set at the median.” So, you have a lot of practices that were in that top quartile saying, “Great, the value-based care sounds awesome.” It’s a real way for health care to move to a different payment model.

What you’ve seen though, is some of those practices that maybe would or most need to transform. There’s no incentive or even a reason for them to opt in to some of these models. Therefore, the big question is it’s politically difficult. I don’t envy the policymakers that have to do this. But, are these models going to have a little bit of teeth in them where you start pushing people to make the transition? As long as you make it optional there will be some subset of folks that think they’ll be better off in this kind of a future world than they are today.

Q. What are some of the core attributes you seek before you begin funding one of these startups?

Jacob: Sometimes a fresh perspective can be helpful but obviously, one needs to have a lot of humility with the U.S. healthcare system. So, we really focus on a combination of things.

First, if someone’s just like a learning machine—because health care is endlessly nuanced and weird, there are those that love that weirdness or find it interesting—and asks, why something is the case or the way it is. It’s really hard to successfully build in the space and we get really excited by folks that have been inventorying surgery centers for three months for example. But they’ve possibly already uncovered something in that research. They’re just more fluent in that space than just about anyone you talk to.

Then, there’s a sort of humility like, “Hey! There’s a lot that we don’t know,” which entails bringing the right folks around the table. So, if you’re a technologist, bring in someone that’s an M.D., or someone who has a lot of experience in whatever it is you’re doing. Form that team right on.

But the one thing that gets me super excited about a lot of the companies we invest in is they’re starting to be like this interesting second generation of founders where essentially, they were tech people, then, they moved into a first wave health care startup like Oscar or Flatiron or HIMMS or any of these companies that were really popular from 2013 to 2019. Then, they went on to form their health care startups.

That’s just incredibly exciting because those people are great technologists. They have all the stuff you’d want in the traditional software world, but they’re not brand new to healthcare. They ran provider networks at Oscar or they did something that was in the weeds in health care but they know the space really well. That kind of archetype of entrepreneur is really exciting. The more you know and the more folks that come into digital health, the higher the chances of that kind of second wave.

Q. The competitive landscape for the startups today has big tech—Amazon, Microsoft, Google, Apple—coming into the core healthcare services space. What’s your take on what this means for smaller companies?

Jacob: It’s not something that we spend a lot of time thinking about. The hardest part is that the health systems are hurting. How do you get your solution to matter for that health system and simultaneously, have nothing to do with the competitive landscape? Do you have a product that’s compelling enough to go through all the hurdles that are required to get something adopted?

As I think about the role of big tech, the Lord knows the pie is big enough in health care and there is a lot of technology that needs to be introduced here so, if we just start moving toward there being more solutions, I think, there’s plenty of pie.

But if I were to reflect on the role of big tech in health care today, there’s definitely a lot of pieces that are interesting or that folks are trying out. However, I wouldn’t say any of the big tech companies have really figured out how to have an at-scale impact on health care. Amazon One is a great example—they tried to build their own business and they ended up acquiring One Medical that had come from the startup world. In some sense, it’s always good to have more smart technologists working on the problem.

From a startup perspective, these are potential acquirers. That’s great as they want to do more in health care. But it’s not like we don’t have companies that go head-to-head with pitching against Google, for instance. I think a lot of that problem, for both the big tech companies and the startups, is much more about figuring out. How do you figure out a product that really has resonance for the startups? If we get really good at that, we’ll get to a world in which there’s a lot of direct competition between them.

Q. One very unique aspect about the competitive landscape is the dominance of electronic health record platforms.

Jacob: We do think a lot about Epic. Epic is probably the most relevant to the world of selling into health systems than Google, Microsoft, or Amazon.

Q. How about the macro environment? This year has been an interesting one—interest rates continue to rise, inflation continues to be high, and the demand environment is uncertain. What’s your advice to founders for 2023?

Jacob: I’m certainly not an economist so I will not pretend to have the kind of prescient macro take. But I would say, obviously there’s a range of things that might happen next year. The advice that we always give is, there’s many ways things could go.

I think next year could have many of the same struggles that this year has. So, we tell our entrepreneurs that they must be ready. If the world starts booming again, great. They can always adjust, accelerate hiring, and change things around. But they may want to plan for what is somewhat a likely case, which is that things don’t get a ton better next year.

Luckily, we worked with a lot of our companies to make sure they’re well capitalized and can navigate that because I don’t think anybody knows whether things will go down or stay flat, and you just want to be prepared for whatever those circumstances are.

Q. What’s your firm’s outlook?

Jacob: We’re very actively investing. We just sent two term sheets in the last few weeks. As a firm, I believe, a lot of the best companies get built in downturns. So, we’re back to where we started. None of the macro trends have changed. Yes, this is like a macro economy change for the time being, but like the things that got us excited about health care a year or three ago, if anything, they’re more exacerbated in this type of environment. The opportunities are very much still there, people just need to figure out on a later stage side, what are things actually worth.

We hope you enjoyed this podcast. Subscribe to our podcast series at www.thebigunlock.com and write to us at [email protected]

Disclaimer: This Q&A has been derived from the podcast transcript and has been edited for readability and clarity.

Recent Episodes

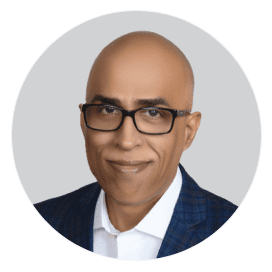

About the host

Paddy is the co-author of Healthcare Digital Transformation – How Consumerism, Technology and Pandemic are Accelerating the Future (Taylor & Francis, Aug 2020), along with Edward W. Marx. Paddy is also the author of the best-selling book The Big Unlock – Harnessing Data and Growing Digital Health Businesses in a Value-based Care Era (Archway Publishing, 2017). He is the host of the highly subscribed The Big Unlock podcast on digital transformation in healthcare featuring C-level executives from the healthcare and technology sectors. He is widely published and has a by-lined column in CIO Magazine and other respected industry publications.